I’ve been fascinated by the world of ecommerce. In particular, the customer journey from start to finish and the enablement tools that service the journey. This fascination led me to begin mapping out different elements of the customer journey to better understand the entire ecommerce landscape.

To deliver a seamless end-to-end customer experience, retailers need to refine their infrastructure, workflows, procurement, and logistic processes with better knowledge of customer personas and a differentiated offering. Ecommerce itself is massive and continues to grow. There are ~8M ecommerce retailers across the world generating $4Tn+ in annual sales and growing at a 16% CAGR. The COVID-19 outbreak dramatically accelerated the trajectory of ecommerce in the US, with the growth rate reaching 32% in 2020, and expected to reach $1Tn+ in annual sales in 2022. Despite ecommerce growth skyrocketing over the past year, there is still much progress to be made as the ecommerce penetration rate of all retail sales is ~18%.

We are still in the early innings.

There are five main themes I am interested in surrounding ecommerce:

Community driven and social commerce

Enablement software that powers the front-end

Personalization that is tied to conversion and revenue

Rise of headless commerce

Improving the post purchase experience through upselling / transparency

Community Driven and Social Commerce

Content and commerce convergence is upon us. Online platforms and marketplaces will serve as consumer guides to discover, review and shop latest trends, products and stores. Discovery platforms have been around for a long time via Instagram, Pinterest and YouTube, and have recently been driven largely by community and personalization, examples being Thingtesting and The Yes. Product discovery can be intertwined with social, as companies like Chums serve as recommendation platforms that help friends suggest products to others.

According to the Activate Technology & Media 2021 report, growth in social commerce will outpace that of both mobile and total ecommerce. Social commerce revenue is expected to grow from $26B in 2020 to $69B in 2024 at a 27% CAGR, whereas mobile commerce and total commerce CAGR’s will be 16% and 12%, respectively over the same time period. Developers of mobile collaborative shopping platforms have designed their platforms to bring in-store personal touches to a real-time virtual shopping experience for customers. As word of mouth has always been the most powerful driver of purchasing, shared buying becomes more credible. Examples include ShopShop, The Ntwrk, Popshop, and many more. Livestream shopping is entertaining and full of discovery, and far more immersive than typical ecommerce experiences.

Separately, SMS has become one of the most direct channels to reach customers. In fact, SMS messages have a 98% open rate, and a 209% higher response rate than phone, email or Facebook.

Enablement Software That Powers the Front-end

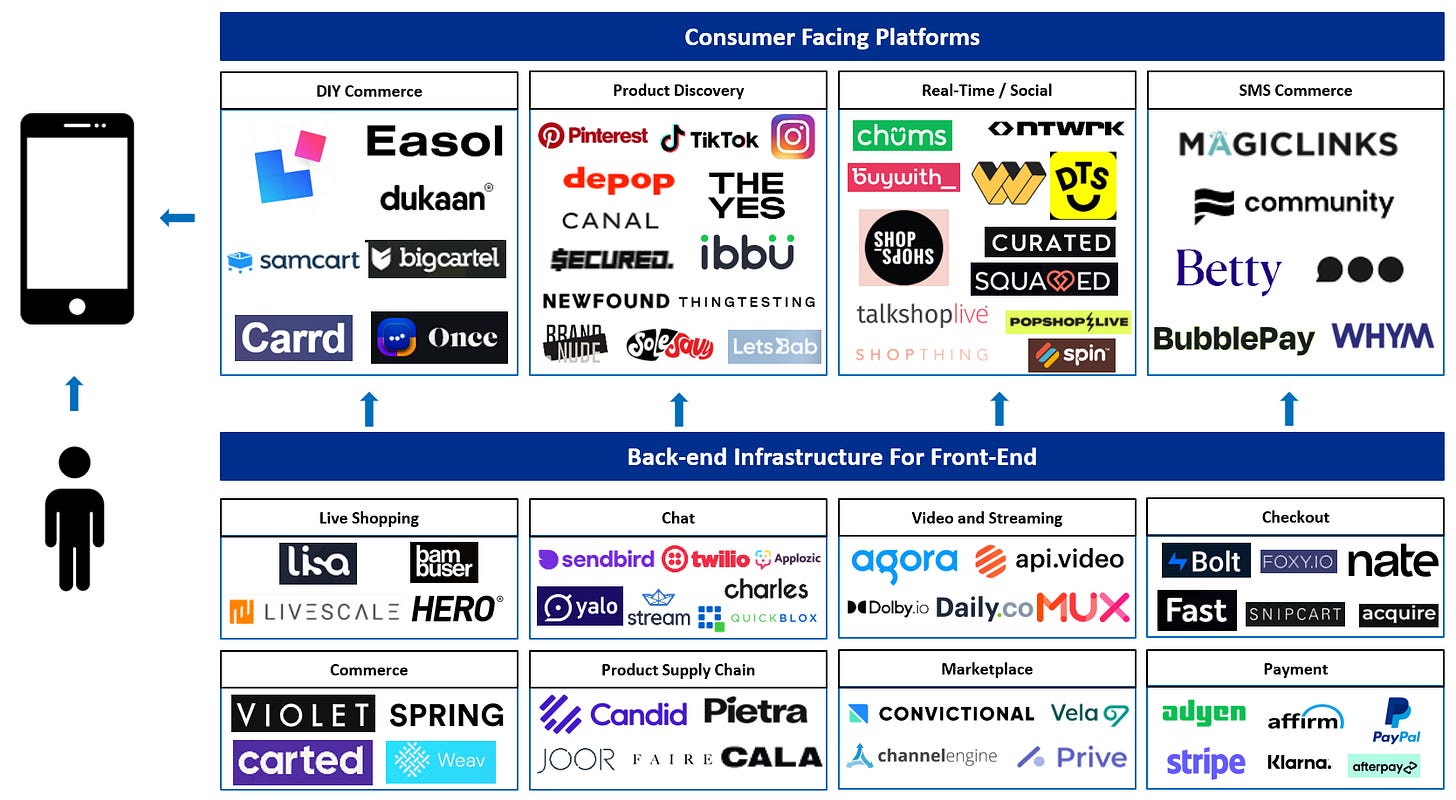

Consumer facing platforms rarely exist without the back-end infrastructure that powers them. This category encompasses start-ups that power purchasing, search and discovery, marketplace infrastructure, and the technology for interactive mobile live video and audio streaming. Enablement technology helps bring automation and efficiency to commerce operations and ultimately improves the customer experience. Across live streaming, Livescale and Hello-Lisa are providers of software to bring live video to online shopping, enabling retailers and brands to offer live stream shopping events. Video has been shown to be much more engaging than images, and with global mobile retail sales expected to account for ~73% of online retail revenue in 2021, there is a lot of opportunity for shoppable video experiences. However, a problem exists as shopping on TikTok or Instagram would often redirect users away from content to a product page with pop-ups, distractions, or a separate UX. Universal commerce API’s like Carted and Violet provide the ability to sell a product from any merchant on any content platform through a direct checkout. As a result, merchants improve customer engagement and loyalty allowing shoppers to make quick and assured buying decisions.

The last few years have also seen the emergence of conversational commerce leading to higher conversion. Companies like Yalo and Charles provide a conversational commerce suite for businesses. They integrate messaging API’s such as WhatsApp and Messenger with commerce backends and bring product catalogue and checkout experiences into conversational journeys enabling brands to effectively communicate with their customers.

Personalization That is Tied to Conversion and Revenue

We have entered the era of complete personalization. As the goal of a website is to convert on designated KPI’s and ultimately drive sales, retailers must find ways to differentiate; personalization allows them to create unique experiences. Relevant and timely messaging is key to educating customers, minimizing friction and building confidence in brand interactions. 80% of shoppers are more likely to buy from a company that offers personalized experiences while 77% of consumers have chosen, recommended, or paid more for a brand that provides a personalized service or experience.

US internet digital ad spend will soon become 2/3 of all ad spend in the US. It is expected to grow from $215B in 2020 to $280B in 2023, while online advertising in particular will go from capturing 55% in 2020 to 64% in 2023, at a CAGR of 14.7%. As individuals will be exposed to more ads, companies will need to deploy a highly personalized approach to realize conversion. At the same time, the expected eradication of third-party cookies will significantly impact publisher revenues as targeting will lead to less effective advertising. Brands and advertisers will no longer have third party cookies to track user behavior. This puts tremendous importance on first-party personalization tools. First party data is critical to understand consumer behavior, segments and trends, ultimately delivering a more tailored and meaningful experience for customers. In a recent article, BCG noted, “an effective retail media network funds additional retailer investments in personalization, which, in turn, drives a better consumer experience, greater customer loyalty, and increased vendor and retailer sales and bottom line.”

Interesting companies in this space are Lily Ai and Lustre that use AI to provide tailored product recommendations, Bloomreach and Constructor that enable better product data to optimize the search experience, and Intellimize that uses ML to optimize each step of a customer journey and personalize websites in real-time, helping drive conversion.

The Rise of Headless Commerce

At the core, headless commerce is separating the front-end (storefront) from the back-end (database) and leveraging API’s to become interconnected. In contrast, monolithic platforms provide an all-in-one solution for building an ecommerce storefront from backend to frontend completely from scratch. They build the backend (cart, checkout, CMS) and create the frontend (UI / UX). However, there are considerable limitations as it doesn’t allow for flexibility to change how the website operates. The benefits of headless commerce are speed, performance and flexibility given that separate API-driven services work better than a single mechanism. API first microservice apps will be designed to support deployment and scalability without hampering performance.

Headless enables merchants to benefit from better performance, faster prototyping, a/b testing and ability to deliver superior e-commerce experiences. Lower load time = higher conversion = more revenue. A headless commerce solution prioritizes storytelling and content experiences to distinguish brand without sacrificing on creativity or online execution. Interesting areas here are CMS platforms that create, manage or distribute content such as Sanity, Strapi and Forestry. Commerce backends such as Swell, Elastic Path, and Saleor Commerce. Front-end platforms such as Shogun, Vue Storefront and Nacelle.

Improving the Post Purchase Experience Through Upselling and Transparency

The post purchase experience spans communication (largely marketing and SMS messaging), cross-sell and upselling, and the supply chain. Cross selling and verticalized marketplaces such as Honeycomb, Coop, and Carro enable brands to sell more easily. Cross selling offers a brand far better recognition and network effects through awareness and data. At the same time, secondhand shopping is a rising movement that is gravitating from trend to commonplace. With the growth in websites like ThredUp, Poshmark, Treet and The RealReal, secondhand buying has never been more accessible. In fact, the secondhand market as a whole is growing 25x faster than retail. The data cycle compounds as marketplaces can grow new revenue streams, gather data to inform future product development, connect to new customer segments, and repeat the process.

This also exists as transparency in shipping has become incredibly important. End-to-end commerce solutions that empower both consumers and brands by allowing consumers to track their packages and simultaneously discover new items, allow brands large and small to enhance the post-purchase experience. Route for example helps solve “where is my order” inquiries which make up 70-80% of customer service-related calls. Platforms in this space help bridge the gap between submitting and receiving an order through transparency.

In summary

Consumers today expect consistent information and personalization across all interactions. Retailers need to take advantage of technology to deliver intuitive experiences to consumers across all channels. I’m excited for enablement technologies to help drive ecommerce even further.

This reflects my personal opinion and is by no means exhaustive. If there are companies I have missed, please reach out.

If you are building, investing, or involved in this space, I’d love to chat! Please reach out to bfutoriansky@cobalt.la or I can be found here and here.

Thank you to Tali, Taylor, Arye and David for their feedback!