The Consumer and Retail Spending Hedge

How can consumers and retailers hedge themselves in a rapidly changing world?

Inflation is beginning to dent consumer demand with 85% of American adults saying rising prices have changed the way they shop, pushing consumers to hunt for deals, discounts and coupons, or simply to shop less. Moreover, many discretionary purchases will increasingly be put on hold. In three separate surveys, 84%, 66% and 63% of those surveyed, signaled that they are planning to cut back spending as a result of price spikes, cut back spending in the face of persistent inflation, and have concerns about affording basic necessities, respectively. In a H2 2022 report on retail and e-commerce industry trends, Morning Consult outlines how consumers have been taking action to save. It is time to save.

Consumers are now under buying pressure and low-income consumers are feeling especially squeezed by the macro. Spending still occurs, just in different ways. Specifically, these consumers are making more inflationary trade-offs, such as buying smaller quantities or cheaper substitutes. Overall, consumer spending remains strong.

What’s Going on With Buy-Now, Pay-Later (BNPL) Offerings?

BNPL services, which allow consumers to split purchase payments into installments, exploded in popularity as Americans turned to online shopping. However, BNPL makes it easy for young consumers to spend more than they usually would without realizing it. More than 40% of Gen-Z consumers will have used BNPL by the end of the year, and the consequences are adding up. In a survey conducted by Accrue Savings, it found that 1/3 of consumers have used BNPL, but 44% have missed a BNPL payment. Even worse, many people are still using credit cards to pay off these loans. Klarna, known for its BNPL product, incurred H1-21 net losses of $581M (up 312% YoY). Losses were primarily caused by rising defaults on borrowing.

The Consumer Financial Protection Bureau (CFPB) noted that the appropriate supervisory examinations need to exist for BNPL companies, just like credit companies. Rohit Chopra, Director, mentioned “We’re already seeing a deterioration in credit performance on BNPL loans. This heavy reliance on data, combined with a mismatch between transparency and choice, elevates the risk of what the report describes as “overextension.” Specifically, there are two types of overextension risk: loan stacking, which is the risk that a borrower takes on multiple Buy Now, Pay Later loans at the same time; and sustained usage, which is the risk of repetitive borrowing causing stress on borrowers’ ability to meet other, non-Buy Now, Pay Later financial obligations.”

BNPL, once a strategic wedge into acquiring users for merchants, will be under a watchful eye as the CFPB plans to start regulating these companies due to worries their fast-growing financing products are harming consumers.

Three areas of excitement

Customer Retention via Cash-Back Opportunities

As some brands struggle with a slow-down in revenue growth and experience compressing margins as the economy cools, it’s becoming difficult to acquire users and retain them. Historically, to acquire users, brands would discount more and more. While users love a good discount, discounts make the merchant less money. Additionally, the expected notion of a promotion may condition the shoppers to rely on promotions, and next time they come back to the store they may also have the same expectation. This is a vicious cycle that always ends with the bottom line being compromised. Interestingly enough, 66% of DTC companies and 54% of traditional retailers note increasing customer acquisition costs as their greatest challenge to achieving their 2022 goals.

Why does cash-back work? Users have an incentive to pay for transactions more directly with cash-back advantages and merchants have an incentive to acquire customers in a less expensive way while optimizing for retention. Honey (acquired by Paypal), Rakuten, and most recently, Price.com, are examples of browser extensions that help with cash back, coupons, and price comparison.

One recent example is a company called Fondue, which recently emerged from stealth to replace ecommerce coupon codes with more profitable and higher converting alternatives via their product CashBack. CashBack replaces coupons with a variety of incentives that a shopper can redeem after they purchase such as cash, gift cards, donations, or more. Thus far, brands that empower their shoppers with CashBack are rewarded with higher conversion rates, profit and engagement. For merchants, consumers will spend the full price on an offering (no incurring a loss like a discount would) and the shopper will receive an incentive to return to the site later and redeem the cashback pegging a win-win situation. Ultimately, a product like CashBack provides a larger AOV, more profitability on first purchase, and higher LTV.

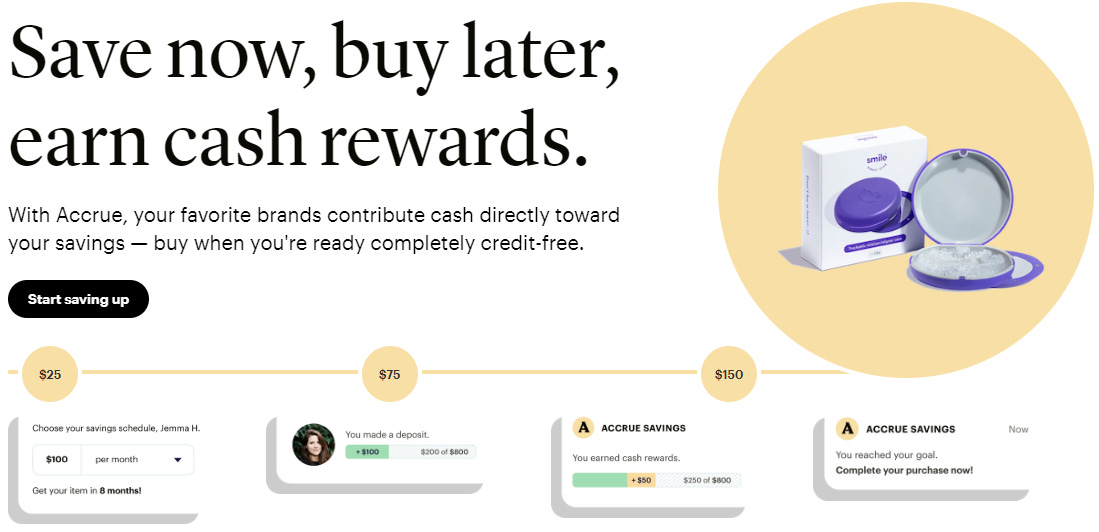

Another great example is what Accrue Savings is doing. The company aims to get people saving with its merchant-embedded shopping experience that rewards consumers for saving up for the things they want to buy. Different from the “BNPL” phenomena, Accrue enables merchants to provide additional payment options and helps consumers save up for items, while also attracting and retaining customers. In a world where customer acquisition and retention are so difficult, Accrue helps brands reach more customers and gives consumers a responsible purchasing option, while earning rewards.

Leveraging Data to Earn and Save

Ultimately, savings help consumers absorb a shock of unexpected expenses and prepare for the future. Fintechs, banks, credit unions and other innovators have stepped up with solutions oriented towards making it easier to save and reducing the friction to do so. Leveraging data by syncing consumer data with applications and uncovering new opportunities to earn money and smart methods to save is one of the ways to do so.

Specifically, properly leveraging first-party data to scale is incredibly important. Pogo, is a mobile application designed to use the power of data for consumers to earn and save on shopping and finances. It pushes recommendations that uncovers significant savings from insurance, bank fee refunds, prescription savings, personalized shopping offers, and more. Users can take control of their data and monetize it. Most consumers don’t know what opportunities exist when it comes to their data and Pogo allows consumers to get paid whenever data or opinions are used for market research and personalized ads. For merchants, it enables them to get real-time consumer purchase data that can be used to drive sales and make decisions. User trust is paramount when dealing with data and Pogo is solving for this.

Helping Retailers Prepare For The Unpredictable

Shifting away from the consumer, retailers are stretched thin. After a two-year spending binge, consumers are buying fewer discretionary goods and returning more purchases. As a result, retailers are stuck with excess inventory and are clearing shelves by selling to liquidators at steep discounts. Ecommerce returns in 2021 totaled $761B in lost sales. In 2021, shoppers returned ~16% of purchases, up from 11% in 2020. 58% of these consumers said they would be willing to do “nearly anything” to avoid returning items. On the retail side, it hurts. Walmart reported a 32% increase in inventory in Q2-22, Target’s Q2 profit sunk as it had to cut prices, cancel orders and unload unwanted inventory.

Further, rising logistic costs, arrival of late products due to supply chain issues, and returned products out of season drive expensive storage fees and a drain on profit margins. Many stores experienced an inventory shortage as demand went through the roof and to react, retailers are ordering more to catch up to demand. Given the excess inventory to hold on balance sheet, some retailers are offering steep discounts on surplus inventory which is a cost to balance sheet and brand. Over-discounting trains customers to expect sales and only buy at reduced prices, while negatively impacting profit margin. In the long run, discounting is a reactive solution and won’t solve inventory issues. Others, prefer not to offer discount for fear of hurting their brands. Liquidation services help brands offload these items, but the process is offline, opaque, and intermediary-driven when sellers need to interact with buyers.

Modern brands need a solution – an ability to move unsold inventory off balance sheets and convert high quality products back into working capital. One such company enabling this is Ghost, a B2B marketplace helping offload excess inventory and enabling brands and retailers to sell, buy, and price inventory in a discreet, efficient, and sustainable way. Ghost handles the back-end by automating the posting, sale and shipment of unsold inventory while offering immediate payment to creditworthy sellers. Suppliers can list product and SKU information, availability, volume and descriptions. Buyers then can bid on goods. This type of marketplace is unique given privacy restrictions to protect brand equity. Ghost ultimately is designed to maximize price performance, minimize time to sale, expand market reach and protect brand for sellers.

Wrapping Up

We’ve covered inflation affecting how Americans shop as they look to cut back and find ways to save, how consumers are still spending, just in different ways, and different solutions for merchants to adopt. These include, but are not limited to, cash-back opportunities, leveraging the power of consumer data to earn money, and ways to discreetly and efficiently offload excess inventory, without selling at a complete loss or tarnishing brand reputation. I’m excited to learn more about various solutions that help both consumers and retailers win. If you are spending time in this space, let’s chat!