Financial technology is still in the early innings with a large opportunity to drive adoption and innovate on cost, compliance and distribution. How about the macro bear market? But how about legacy infrastructure?

Financial institutions (FIs) are behind in adopting technology: Legacy infrastructure has yet to adopt basic emerging technologies such as cloud computing or APIs

Incumbents have large cost structures and require a heavy lift for change: FIs have large fixed costs and have trouble attracting top talent that otherwise wants to innovate. At Accenture, we would have long-lasting projects to drive any marginal change for the big banks

This results in being slow on innovation: Simple tasks take a long time and require manual assistance while simple features are not available to deploy

Fintech adoption is early. According to the EY Global Fintech Adoption Index, consumer fintech adoption in the U.S is 46%, which lags behind other countries. At the same time, 25% of U.S households are either unbanked or underserved.

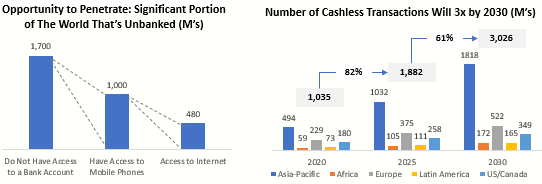

A large part of the world is still underserved by existing financial institutions given that 1.7B people do not have access to a bank account today. Of those, 1B have access to a mobile phone and 480M have internet. By 2030, the number of cashless transactions will be about 3x the current levels, across all regions. Cashless transactions are expected to reach ~3T by 2030. Riding this tailwind, there is an opportunity to service this population with digital solutions.

Where are we with Crypto and DeFi adoption? Total cryptocurrency market cap reached a record of ~$3T in November 2021, and total DeFi Total Value Locked (TVL) also reached a record in the same time frame. Since then, we have seen both plummet to <$1T and <$100M, respectively. This can be attributed to a wide number of factors from inflation at a 40-year high, interest rate hikes, the continuous war, and bad events in crypto, among other reasons.

Where does that leave adoption? Global crypto users reached 295M as of Dec-21, growing 178% since Jan-2021. At the same time, unique addresses that used DeFi protocols reached ~4M as of Dec-21, growing 243%. Metamask users represent ~1% of Facebook, ~9% of Twitter and ~19% of Discord MAUs, having been founded much later. Global crypto users (295M) represent ~4% of the global population while 12% of Americans (40M) used crypto last year. So, are we early?

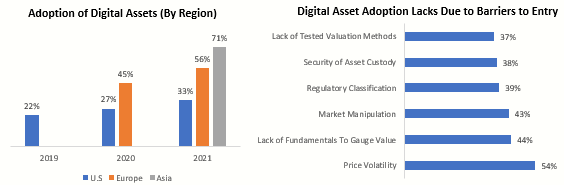

Globally, 52% of investors surveyed have an investment in digital assets while 44% of investors have an increased likelihood of investing in digital assets following the Fidelity survey. The U.S (33%) currently lags behind both Europe (56%) and Asia (71%) in digital asset adoption, demonstrating white space opportunities for the U.S. However, there are several barriers to entry for widespread digital adoption. Price volatility continues to be the most significant barrier to adoption while the lack of fundamentals to gauge appropriate value comes from nuanced protocols evolving within DeFi (valuations derived based on volume or total assets pooled).

Although the data points to untapped opportunity, it is difficult to ignore the risks given the market collapse of the last six months. From a consumer perspective, individuals have lost a lot of money in the public markets and inflation is driving down spending intent for non-affluent consumers across most categories. Even further, the promise of superior returns relative to the market via DeFi has come crashing down with recent news of the Terra/Luna collapse and Celsius halting withdrawals, locking up billions in funds, among other events. Unfortunately, I believe we will see many more of these incidents come to the light in the next few months. Given these challenges, certain themes will prevail to help mitigate these barriers:

Incumbent financial institutions will look to crypto-native infrastructure to help launch new products for customers and allow them to participate, with compliance and security in place

Enabling transparency, security and predictability via risk mgmt. solutions to combat price volatility, lack of fundamentals and market manipulations

Steady shift to a cashless global society will need the proper digital payment infrastructures

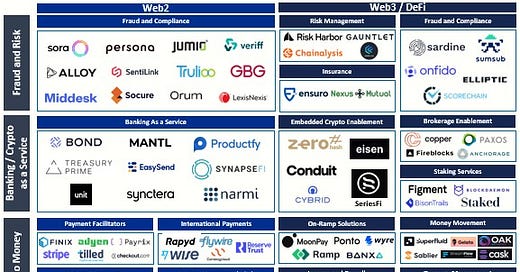

Theme: Identity, Fraud and Risk Management to Enable the Future of Crypto

Both retail and institutions will need transparency, security and predictability to reduce high decline rates, false-positives, price volatility and market manipulation. Building foundational trust is essential for the future of this industry and to protect retail and institutions from losses. Crypto criminals stole $14B in 2021 due to losses from scams and thefts, growing 79% YoY. At the same time, total spend on digital wallets is expected to 2x to $10T by 2025 with 83% of digital wallet growth being fueled by adoption of digital payments. Core infrastructure needs to be built to prevent this.

Consumer-facing crypto applications and on-ramp solutions need fraud and compliance solutions to onboard customers faster and meet regulatory compliance. Infrastructure needs to be built to make crypto more accessible as offering easier fiat-to-crypto on-ramps will be instrumental in adoption and fraud is one of the biggest challenges for enabling instant access to crypto. Fintechs and crypto companies alike need end-to-end fraud services to manage risk and compliance (Sardine and Alloy as examples). On the DeFi side, the ecosystem has grown in complexity and needs strong risk mgmt. infrastructure to continue capital inflows towards protocols. Companies need better on-chain protocol management and risk assessment tools (Gauntlet and Chaos Labs for example) to manage blockchain protocols and provide more transparent information.

Theme: Fintechs Need To Spin Up Banking and Crypto Products

Navigating existing financial systems is difficult. Fintechs will need to adopt new systems to deploy and manage products for an increasingly complex and global user base. Despite all the innovation and growth, it is still very expensive and time consuming to launch a fintech company. Embedded infrastructure allows any platform to integrate banking or digital assets into their own customer experience quickly and easily (via API endpoints). Banking-as-a-service (BaaS) enables companies to spin up checking and savings accounts quickly and offer more sophisticated features (Synctera as an example).

At the same time, fintechs are under pressure to deliver native access to crypto and DeFi. However, integration is a heavy lift, compliance is complicated, and most companies lack the resources and in-house expertise to do so. Crypto banking as a service enables companies to embed crypto and DeFi features directly into their products, providing all the necessary infrastructure, compliance and security. Specifically, it enables fintechs, neobanks, exchanges and payment groups to offer digital asset trading and custody, crypto-backed rewards, yield products and much more. Companies in this space aim to be a one-stop shop for financial institutions to plug their own products into these ecosystems. Ultimately, consumer demand will put pressure to meet compliance requirements across digital asset investing. Companies like Zero Hash, Conduit and SeriesFi are setting standards in this space.

Theme: Accelerating Time to Money

Real-time payments and funding are essential to match heightened consumer expectations around the products and services they use. Whether as a business or consumer, there is a demanding need for instantaneous “time to money” or rather, the ability to transact with digital payments. Manually intensive payment methods are likely to lead to high error and failure rates, making companies and individuals vulnerable to security risks and increasing costs. Building payment rails, facilitating international payments and enabling money movement via instant ACH helps time to money accelerate. Astra as an example, helps provide automated, bank-to-bank transfers for fintech startups and enterprises, acting as a fast and risk mitigated funding solution for users. As of 2021, the ACH network moved ~$73T, growing 17.7% YoY. The top 50 financial institutions by volume amount to <$25T of the portion, resulting in large incremental TAM.

By default, crypto has an irrevocable transfer model where you receive instant money. Users, must be on-ramped from the fiat world via payment gateways, have instant funding in their accounts available to use, trust the platforms they are using with security in place, and be able to stream dollars from one account to another, in real-time, concurrently. Software, must facilitate fiat-to-crypto payments conversion, underwrite risk of accounts to provide instant funding via ACH, enable continuous settlement with per-second netting, and offer gateways to access DeFi yield earnings through treasury management.

Treasury management is a large opportunity for innovation. There are three focuses:

Web3 Companies: DAO treasury mgmt. players focused on serving corporate treasury teams at these companies

Web2 Companies: Treasury mgmt. players focused on helping startups with considerable cash balances in the bank to deploy

Enterprise and Institutional: Treasury mgmt. focused on large corporations and hedge funds deploying capital into crypto

Another area I’m interested to explore is the evolution of the subscription business model which I cover in a previous article found here. Ultimately, the rising adoption of subscription models based on consumer and business demand created an increasing need to upgrade legacy systems. The potential for the subscription model grows even further when DeFi enables payments to be “streamed” in real-time. The vision here, for a user, is to receive wages by the second, simultaneously stream money into savings and investment accounts, pay back any loans, and buy, and schedule ongoing buy/sell orders based on event driven outcomes.

A large part of the world is still underserved and underbanked by existing financial institutions. Fintechs need to adopt systems to deploy and manage products for an increasingly complex global user base. With this, real-time money movement is essential. For this to exist, the future of payments and onboarding revolves around transparency, security and predictability in the services we use. I believe in a world of financial inclusion and I’m excited for the technologies that will help enable widespread adoption of the services we need to exist.

If you are building, investing, or involved in this space, I’d love to chat!

Great piece, Ben!